stock option tax calculator ireland

125 corporate tax rate. Stock options restricted stock restricted stock units performance shares stock appreciation rights and.

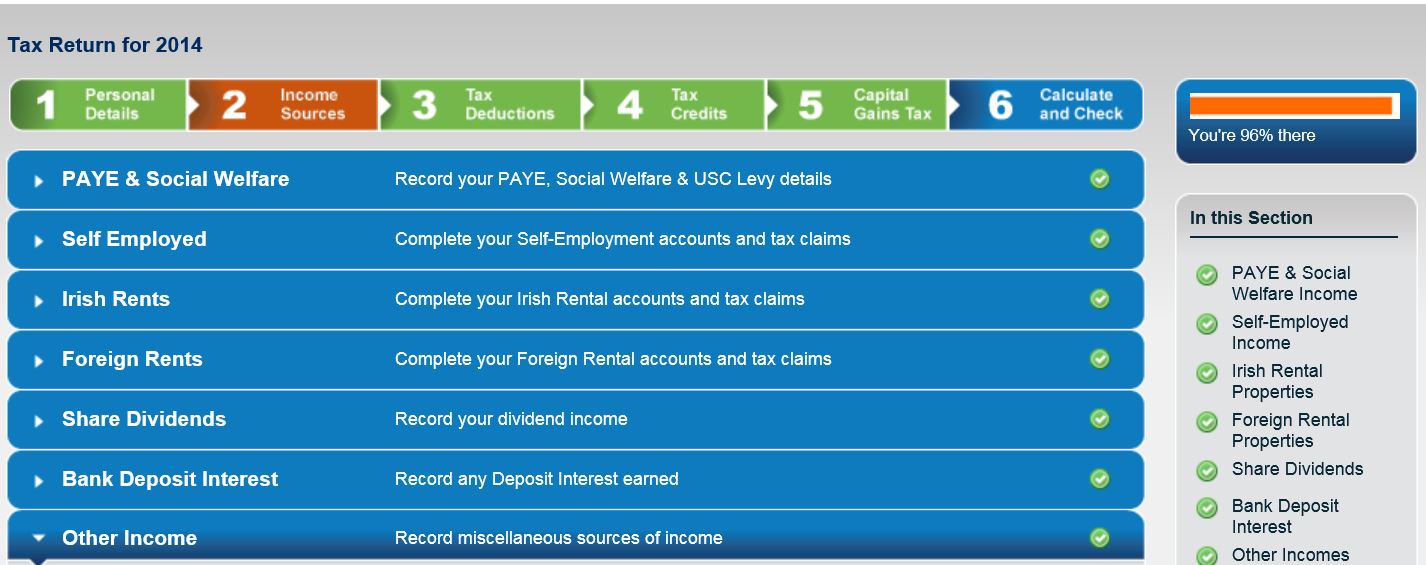

Paylesstax 45 Minute Tax Return

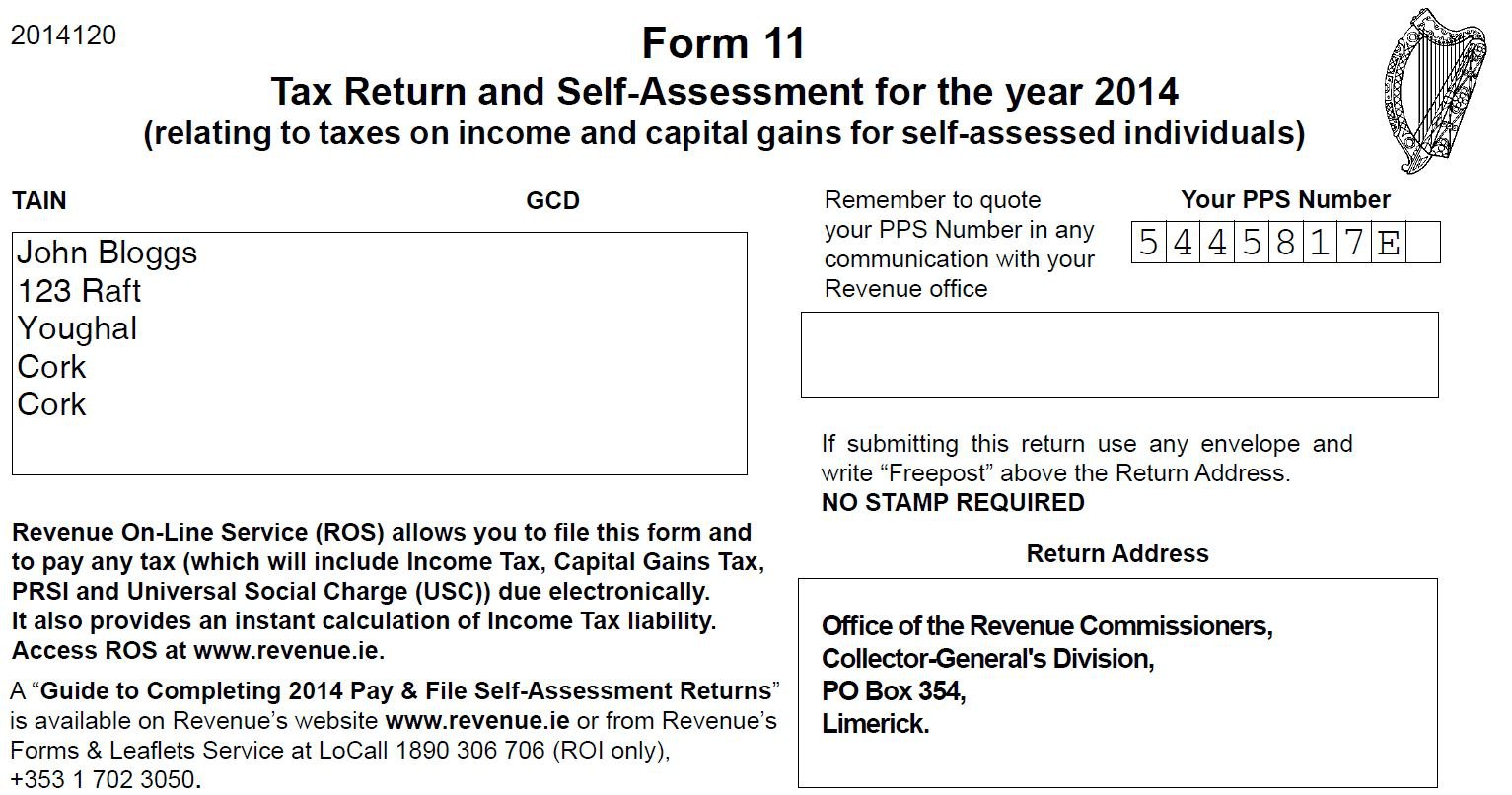

How to Calculate your RTSO1 Share Option Tax.

.png?width=1952&height=840&name=Add%20a%20subheading%20(2).png)

. 2022 2021 Income Tax Calculator TaxCalc allows you to estimate your take home pay based on your total pay pension contribution and personal circumstances. This paper profit is immediately liable for income tax and must be paid over to the Revenue within 30 days of exercising the. Click your cursor in the box Ticket price and when you find the ticket of your choice click on the ticket price and it will automatically be entered into the savings calculator box.

On this page you will find our easy-to-use tax calculator which will show you how much you have to pay as corporate tax dividend tax and Value Added Tax in Ireland. The Global Tax Guide explains the taxation of equity awards in 43 countries. The results should in no way be viewed as definitive for personal tax purposes for your individual tax payment.

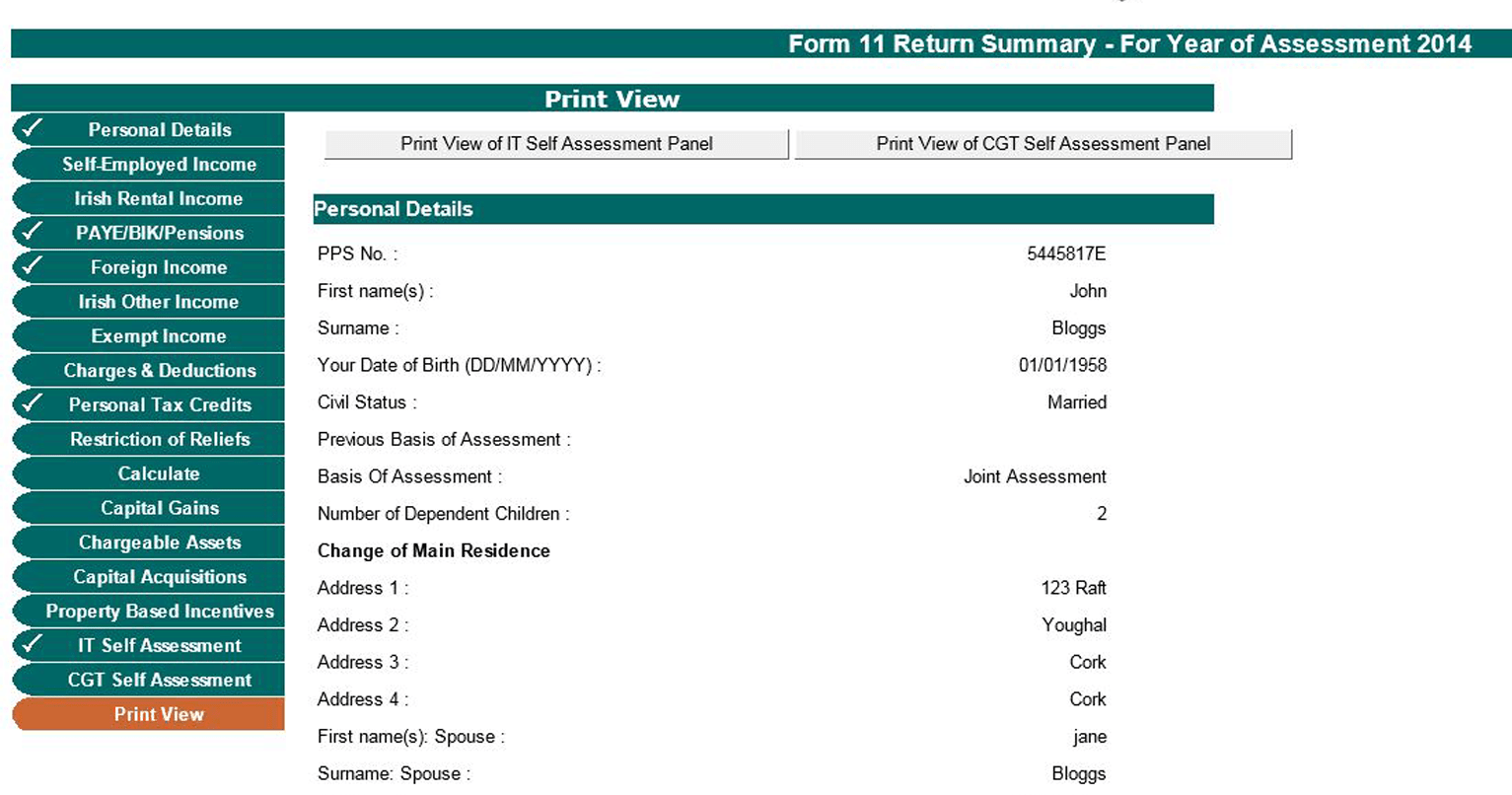

Emily made an Exercised Share Profit of 20000. EToro income will also be subject to Universal Social Charge USC. You can make your payment using.

This calculator is designed for illustrative purposes only. So if you made a 100000 gain on a property that was your private residence for 5 years and rented for an additional 5 the taxable gain would be 510 X 100000 50000. Calculate Tax Clear Form.

Providing the scheme meets the required. Capital Gains Tax on RSUs and Non-Doms. In Ireland the first 1270 of.

Call us now at 353 1 254 6150 to set up an appointment with our. In most cases the RSUs are held in a brokerage account outside Ireland. The key features of Irelands tax regime that make it one of the most attractive global investment locations include.

25 RD tax credit. A share option is the right to buy a certain number of shares at a fixed price sometime in the future within a company. It will estimate your take-home pay based on your salarywages pension contributions and personal circumstances.

Value of Shares10000 shares 3 30000. The AMT adjustment is 1500 2500 box 4 multiplied by box 5 minus 1000 box 3 multiplied by box 5. The rate for the DEGIRO Trackers and Investment Funds Core selection is based on a Fair Use Policy.

TaxCalcie is a simple to use 20222021 Budget calculator. Approved Profit Sharing Schemes allow an employer to give an employee shares in the company up to a maximum value of 12700 per year. No responsibility is taken by Deloitte for any errors or for any loss however occasioned to any person by reliance on this.

These shares are a benefit in kind BIK. For more information see here. Paul Sheridan is our company formation specialist and he can help local and foreign businessmen open companies in Ireland.

This capital gain is subject to a tax called Capital Gains Tax CGT which is currently charged at a rate of 33 in Ireland. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. Hi everyone Im interested in starting to trade US stock options contracts.

Cost of Shares10000 shares 1 10000. The number of shares acquired is listed in box 5. The Ireland Capital Gains Tax Calculator is designed to allow free online calculations for residents and non-residents who have accrued income from capital gains in Ireland.

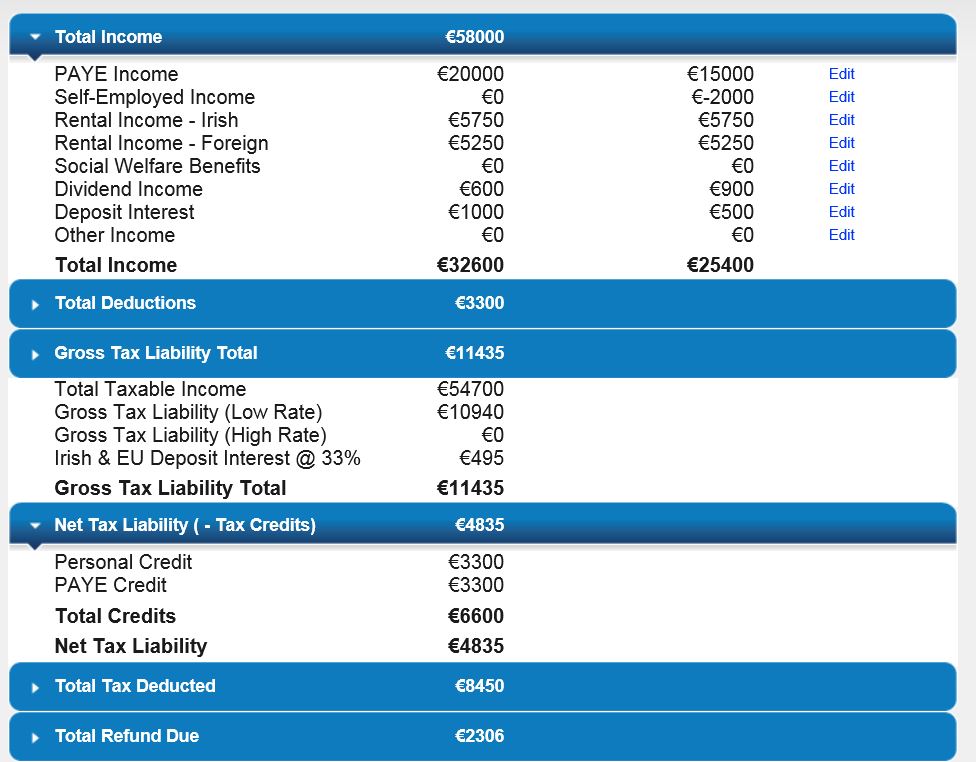

How to pay. This is calculated as follows. Income Tax rates are currently 20 and 40.

Financing cost charged at overnight market rate. If you did live. In essence this means that the money is outside Ireland and if you.

Click here for more insights from Deloitte. You must pay RTSO within 30 days of exercising the options. USC is tax payable on an individuals total income.

The problem is that there is literally no information in the Internet about how this activity would be taxed in. An excellent online calculator for Corporation tax calculations in Ireland general companies banks financial institutions and non operating entities with 2022 Corporation tax rates. The 30 day period includes the exercise date.

This places Ireland on the 8th place in the International.

Paylesstax Share Options Rtso1 Tax Calculator Paylesstax

Ireland Cryptocurrency Tax Guide 2021 Koinly

.png?width=2108&name=Add%20a%20subheading%20(9).png)

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise

Tax On Share Options In Ireland How Stock Options Are Taxed In Ireland

Ireland Cryptocurrency Tax Guide 2021 Koinly

Paylesstax 45 Minute Tax Return

Paylesstax Share Options Rtso1 Tax Calculator Paylesstax

How To File Taxes For Etfs In Ireland Mrs Money Hacker

![]()

Best Ebay Fee Calculator For Ireland 2022 Investomatica

Paylesstax 6 Easy Steps Paylesstax

Paye Documentation Thesaurus Payroll Manager Ireland 2020

Ireland Cryptocurrency Tax Guide 2021 Koinly

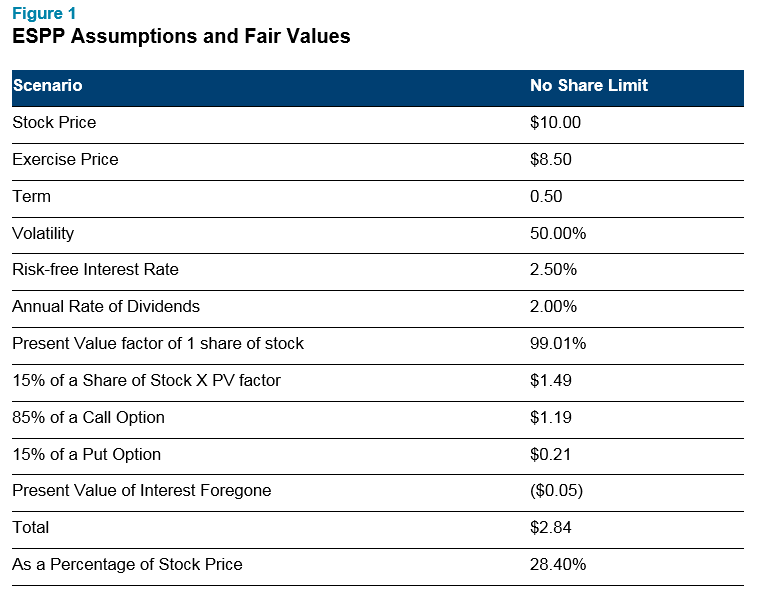

Determining The Fair Value Of Your Espp

Paylesstax 6 Easy Steps Paylesstax

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise

.png?width=1952&height=840&name=Add%20a%20subheading%20(2).png)

Tax On Share Options In Ireland How Stock Options Are Taxed In Ireland

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise